orina-garden.ru

Prices

Should I Get An Apple Credit Card

Buy anything from Apple — including services like Apple Music or Apple TV, games and apps from the App Store, even in-app purchases — and enjoy 3% cash back. Apple Card is limited to the United States, but in the future, it could be expanding to additional countries much like Apple Pay has expanded, and Apple was. Apple Card is a credit card designed to support your financial health through smarter tools and greater transparency. To be eligible for the Program, you must have received or service, including Apple Card, affect your credit score, or have any other outcome or result. 2% on all purchases, but 3% for buying more Apple services. That's sticky. If you can roll your Daily Cash into more games on Apple Arcade or to pay off your. The JD Power US Credit Card Satisfaction Study has found the Apple Card to be the best co-branded credit card with no annual fee Expand Expanding Close. A simpler, smarter credit card. Whether you buy things with Apple Pay or with the laser‑etched titanium card, Apple Card can do lots of things no other credit. This card helps users get exclusive benefits, discounts, and cashback on their purchases at any Apple store. The Apple credit card also aims to help users enjoy. Cons · The Apple Card doesn't offer purchase protection, extended warranty coverage or other benefits that are common among rewards cards. · There's no sign-up. Buy anything from Apple — including services like Apple Music or Apple TV, games and apps from the App Store, even in-app purchases — and enjoy 3% cash back. Apple Card is limited to the United States, but in the future, it could be expanding to additional countries much like Apple Pay has expanded, and Apple was. Apple Card is a credit card designed to support your financial health through smarter tools and greater transparency. To be eligible for the Program, you must have received or service, including Apple Card, affect your credit score, or have any other outcome or result. 2% on all purchases, but 3% for buying more Apple services. That's sticky. If you can roll your Daily Cash into more games on Apple Arcade or to pay off your. The JD Power US Credit Card Satisfaction Study has found the Apple Card to be the best co-branded credit card with no annual fee Expand Expanding Close. A simpler, smarter credit card. Whether you buy things with Apple Pay or with the laser‑etched titanium card, Apple Card can do lots of things no other credit. This card helps users get exclusive benefits, discounts, and cashback on their purchases at any Apple store. The Apple credit card also aims to help users enjoy. Cons · The Apple Card doesn't offer purchase protection, extended warranty coverage or other benefits that are common among rewards cards. · There's no sign-up.

The Apple Card has no yearly fees, no fees for transactions, and no fees for penalties. It does have credit limits. The limits are determined by the. Because Apple pushes the card as part of its ecosystem, users reap more rewards when they buy Apple products and use Apple Pay on their iPhones to pay for. Get up to 3% Daily Cash on every purchase. Pay no To request a titanium card you must add Apple Card to Wallet on an eligible iOS or iPadOS device. If you successfully complete the program, you will receive an invitation to reapply for Apple Card that's good for 14 days The monthly credit review required. The Apple Mastercard from Goldman Sachs is a good credit card for people who make a lot of purchases with Apple Pay, and it's easily worthwhile given its. Almost all applicants who submitted complaints to the. Department expressed the belief that their credit scores should have led to approval for an Apple. Card. Possibly because Apple is a US based company and the bank who issues the Apple card is Goldman Sachs in Salt Lake City, Utah. They must have. The Apple Card launched in as a cash-back card tailor-made for the brand's enthusiasts. With a $0 annual fee, 3% cash back (also called Daily Cash) on. But there's a big “but”: you must use Apple Pay to get higher rates. The physical card only gives 1% cash back on purchases, which could be better when the. have a cosigner (must be 21 years of age or older). Credit Builder. Credit Builder Credit Card. Features. Secured Credit up to $5,; Help establish or to. My odds on this was outstanding and I was right around at the time. Got a $ limit. I get 3% back on all Apple purchases (Apple music, Apple TV etc) 2%. If your application is approved and you accept your Apple Card offer, a hard inquiry is made. This may impact your credit score. About sharing an Apple Card. If. Apple Card is a credit card created by Apple Inc. and issued by Goldman Sachs, designed primarily to be used with Apple Pay on an Apple device such as an. The Apple Card has no yearly fees, no fees for transactions, and no fees for penalties. It does have credit limits. The limits are determined by the. must be part of the same Apple Family Sharing group have their own Apple Card yet. Apple Card Family allows two partners to merge credit. Mastercard ID Theft Protection TM. Monitor your credit file for fraud, receive alert notifications about suspicious activity and get assistance from a. However, it's not a must-have, since other cards offer higher cash back rewards on all purchases. Is the Apple Credit Card worth it? The Apple. Get answers to frequently asked questions about using your Wells Fargo card to make payments with Apple Pay. Why you should go for it It has no fees and low financing charges. If you miss out a bill payment, you do not have to pay that annoying late. Apple Card is a credit card created by Apple Inc. and issued by Goldman Sachs, designed primarily to be used with Apple Pay on an Apple device such as an.

Business Line Of Credit Vs Loan

Explore the business loan and business line of credit options available at Navy Federal. Reach out to speak to a representative if you have questions about. A personal line of credit (PLOC) can be used to consolidate debt, finance a home renovation, pay for a wedding or big event, and more. Unlike a personal loan. Like repayment terms for business loans, repayment terms for business lines of credit tend to be short. It's common to see terms of two years or less, though. A line of credit and a term loan are two popular types of business loans. To decide which is right for your business, you need a clear understanding of each. A business line of credit is a flexible financing option that allows you to borrow up to a certain amount, or credit limit, to cover short-term working capital. A business line of credit is a loan with numerous benefits to borrowers. Here's how a business line of credit works. While getting a business loan is a lot faster than it used to be, if you have an existing banking relationship or a personal line of credit, a personal loan can. Payments for a business line of credit are due regularly and are determined by how much you spend. · A term loan is paid back in predictable installments, often. A business line of credit tends to work best for those who want continuous access to funds but don't have an exact or immediate need. Explore the business loan and business line of credit options available at Navy Federal. Reach out to speak to a representative if you have questions about. A personal line of credit (PLOC) can be used to consolidate debt, finance a home renovation, pay for a wedding or big event, and more. Unlike a personal loan. Like repayment terms for business loans, repayment terms for business lines of credit tend to be short. It's common to see terms of two years or less, though. A line of credit and a term loan are two popular types of business loans. To decide which is right for your business, you need a clear understanding of each. A business line of credit is a flexible financing option that allows you to borrow up to a certain amount, or credit limit, to cover short-term working capital. A business line of credit is a loan with numerous benefits to borrowers. Here's how a business line of credit works. While getting a business loan is a lot faster than it used to be, if you have an existing banking relationship or a personal line of credit, a personal loan can. Payments for a business line of credit are due regularly and are determined by how much you spend. · A term loan is paid back in predictable installments, often. A business line of credit tends to work best for those who want continuous access to funds but don't have an exact or immediate need.

Explore loans & lines. Business loans, business lines of credit, SBA loans, equipment financing, practice financing. Why a Wells Fargo Unsecured Business Loan? These loans allow businesses to finance one-time expenses with the flexibility to pay over a short or longer term. A small business line of credit gives you flexible access to cash on an as-needed basis. This type of financing allows you to draw cash from your total. Unlike a term loan—where money is deposited into your account and you repay principal and interest from day one—a line of credit is a pre-approved amount of. As with a loan, you will pay interest using a line of credit. Borrowers must be approved by the bank, which considers credit rating and/or your relationship. Chase Business Line of Credit Annual Fee: % of line ($ min; $ max). Fee can be waived if average utilization over the year is 40% or higher. Chase. A business line of credit is a flexible financing option you can draw from as needed. Interest is only charged on the amount of money you borrow. The credit line is automatically paid down with available funds in your everyday operating account. Simple Access. Access additional funds for your business. A business line of credit is a flexible loan for businesses of all sizes. It allows businesses to borrow money up to a certain amount when needed. Term loans are conventional small business loans that have a fixed repayment term, and the interest rate is charged on the entire amount borrowed. A small. A business line of credit gives you ongoing access to funds for your day-to-day operations. If you prefer a one-time lump sum of money, a loan may be right for. Unlike a term loan—where money is deposited into your account and you repay principal and interest from day one—a line of credit is a pre-approved amount of. Unlike many small business loans, an unsecured line of credit is not designated for a specific purpose or purchase. For this reason, it's a good choice for. How does my line of credit payback work? With an OnDeck Line of Credit, draws are consolidated into one loan with one easy weekly or monthly payment. As you. Though they have better rates than credit cards, compared to other traditional financing options, say, loans or installment loans, both revolving and non-. With a line of credit, funds may be borrowed, repaid and borrowed again. You borrow as little or as much as you need, up to your available credit limit, and. A business line of credit is a type of small business financing that works fairly similarly to a credit card. Once approved, you'll have the option to. Loans can be easier to obtain than business loans, depending on your personal credit. Many personal loans are unsecured, meaning you don't need collateral. If it's secured, that means the business owner has offered collateral such as personal property or other assets as security for repayment of the debt. If the. The difference between a line of credit and a loan is that a loan is borrowed as a lump sum, while a line of credit can be used and repaid on an ongoing basis.

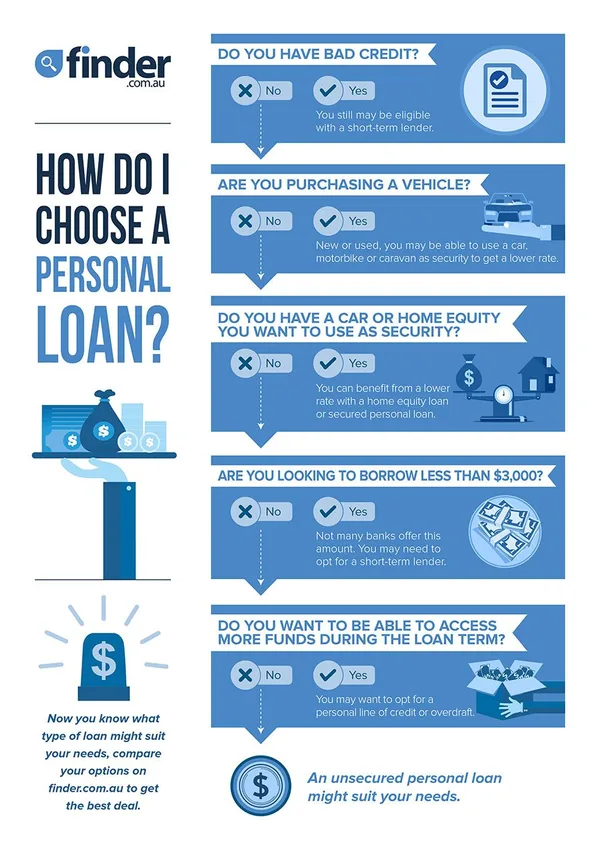

Personal Loans Australia

We offer personalised low rate loans from $ to $ Apply online in minutes and receive your funds quickly. When you borrow money from family or a friend, there's usually a promise that you'll pay them back. A personal loan from an official lender with an Australian. A personal loan lets you borrow money to pay for something special, like a holiday, car or home renovations. You have to repay it with interest over a fixed. Apply for an instant Personal Loan online with flexible repayment options, attractive tenures, minimal documentation, and great interest rates at AU Small. Secured Personal Loan · Comparison rate · Range: % p.a. to % p.a.. Representative rate^: % p.a.. Comparison rate for eligible energy-efficient. Personal loan · Flexible loan terms from 1 - 5 years. · Quick online application – apply in around 10 minutes. · Flexible loan amounts to suit your needs, from. Our personal loans have flexible repayment options, no exit fees, and no additional repayment fees. Compare interest rates and apply today. Quick Online Loans: Get Paid In 60 mins* ⏱ Cash Loans $$2k, Personal Loans $2k-$5k Over Million Loans Approved. Find Personal Loans with iSelect - Compare some of Australia's leading Personal Loan Providers. We offer personalised low rate loans from $ to $ Apply online in minutes and receive your funds quickly. When you borrow money from family or a friend, there's usually a promise that you'll pay them back. A personal loan from an official lender with an Australian. A personal loan lets you borrow money to pay for something special, like a holiday, car or home renovations. You have to repay it with interest over a fixed. Apply for an instant Personal Loan online with flexible repayment options, attractive tenures, minimal documentation, and great interest rates at AU Small. Secured Personal Loan · Comparison rate · Range: % p.a. to % p.a.. Representative rate^: % p.a.. Comparison rate for eligible energy-efficient. Personal loan · Flexible loan terms from 1 - 5 years. · Quick online application – apply in around 10 minutes. · Flexible loan amounts to suit your needs, from. Our personal loans have flexible repayment options, no exit fees, and no additional repayment fees. Compare interest rates and apply today. Quick Online Loans: Get Paid In 60 mins* ⏱ Cash Loans $$2k, Personal Loans $2k-$5k Over Million Loans Approved. Find Personal Loans with iSelect - Compare some of Australia's leading Personal Loan Providers.

Apply for Revolut personal loans between and It's free to start your loan application and we'll always tell you all costs upfront. * Pepper Money Unsecured Personal Loan interest rates range from %% p.a. (Comparison rates range from %% p.a.#) and Secured Personal Loan. Whether you're renovating your home, planning an overseas trip or buying a car – a personal loan can be a great option. Choose from Australian Unity's great. For Low Rate Personal Loans Online Up To $, Choose MyOzMoney. Fast Online Approval. Competitive Interest Rates. No Early Exit Fees. Apply Online Now! Compare a selection of unsecured personal loan rates in Australia, with ranges based on the borrower's credit score and other factors. For an Unsecured Personal Loan based on a borrowing amount of $15, and term of 7 years with an interest rate of % p.a. (comparison rate of % p.a.). Personal Loan Unsecured · Low approval fee · No monthly or annual fees · Free redraw facility. % p.a. Personal loans by ING % p.a. % p.a. % p.a. % p.a. Why apply for an ING Personal Loan? Personalised fixed interest rate. Get your. Ausloans offers competitive Australian personal loans with low interest rates, designed to help Australians get funds for almost anything they need. Our low. Representative example total repayment amount: For a personal loan of $20, borrowed for 60 months with a minimum interest rate of % (comparison rate^ of. Be 18 years or over · Be a permanent Australian resident · Be currently employed and earning at least $25, gross per annum · Be able to demonstrate a good. ANZ offers two types of unsecured personal loans between $5, and $50, Both the ANZ Fixed Rate Loan and ANZ Variable Rate Loan can be used for a specific. Anyone over 18 years who is a citizen or permanent resident currently living in Australia can apply for a Liberty personal loan. Applicants need to be. Interest rates start at % and could be as high as % based on your personal circumstances and loan term · Australian residents and citizens only. Am I eligible for a Plenti personal loan? · Age: 18 years or older · Citizenship: Australian citizen or permanent resident · Income: earn over $25, annually. Turn your dreams into a reality today with an unsecured personal loan. Start by getting your personalised rate estimate in minutes, with no impact on your. Ready to apply for an HSBC Personal Loan? · Be aged 18 years or older · Be an existing HSBC Australia customer for at least 12 months; or have an existing. Personal Loan Statistics in Australia · Total amount borrowed with new personal loans each month: $ billion · Average new personal loan amount: $22, Australia's award-winning online lender. Fast % online. Borrow up to $ unsecured. No monthly account keeping or early repayment fees. Loan Terms. Maximum term of 10 years and minimum amount of $1, apply to Lifestyle Personal Loans. Full terms, conditions, fees and charges are available on.

Good Businesses For Small Towns

A home and garden store can be among the best businesses to open in a small town, especially if your community has a lot of homeowners and DIYers. Offering. Erwin, Tennessee. Erwin, Tennesee's Unaka Bike Park helps capitalize on one of the town's best businesses while creating a new recreation space for the town's. Consumer products are a great and boring business to do when you are living in a small town. You can start offering them special clubbed offers. Still, successful small town businesses get to know their customers by name and habit, and vice versa. Shop owners learn what you like, and will special order. good professional photography. How can it be possible to own a successful, six-figure business in a tiny hamlet? I'm here to let you in on my secrets! 1. Our mission is to grow small businesses in small towns because your geographic location shouldn't inhibit the resources needed to nurture good ideas. We do this. A List Of 27 Most Successful Business Ideas For Small Towns · 1. Coffee Shop/Wine Bar · 2. Car Wash and Gas Station · 3. Bed and Breakfast · 4. Ice Cream Shop · 5. How close is the town to larger cities and/or transportation hubs? If your small town is within driving distance of a larger city, you might enjoy the best of. Open A Bar Bars a unique experience and having a local one is a no brainer. They are great for towns for both locals and tourists alike. This is especially. A home and garden store can be among the best businesses to open in a small town, especially if your community has a lot of homeowners and DIYers. Offering. Erwin, Tennessee. Erwin, Tennesee's Unaka Bike Park helps capitalize on one of the town's best businesses while creating a new recreation space for the town's. Consumer products are a great and boring business to do when you are living in a small town. You can start offering them special clubbed offers. Still, successful small town businesses get to know their customers by name and habit, and vice versa. Shop owners learn what you like, and will special order. good professional photography. How can it be possible to own a successful, six-figure business in a tiny hamlet? I'm here to let you in on my secrets! 1. Our mission is to grow small businesses in small towns because your geographic location shouldn't inhibit the resources needed to nurture good ideas. We do this. A List Of 27 Most Successful Business Ideas For Small Towns · 1. Coffee Shop/Wine Bar · 2. Car Wash and Gas Station · 3. Bed and Breakfast · 4. Ice Cream Shop · 5. How close is the town to larger cities and/or transportation hubs? If your small town is within driving distance of a larger city, you might enjoy the best of. Open A Bar Bars a unique experience and having a local one is a no brainer. They are great for towns for both locals and tourists alike. This is especially.

Agriculture is the primary source of income in the villages. One of the finest possibilities for your organization would be to open a fertilizer wholesale store. 1. Bakery. Whether you're selling freshly baked bread, cookies, pastries, or beautiful art cakes for weddings and parties, you'll find that every town loves a. Small Towns May Provide Opportunities For Growth The good news is the opportunity for your coffee shop business to thrive. Depending on some factors we'll. Planning where development should or should not go can help a rural community encourage growth in town, where businesses great new places by building lively. Affiliate websites are one of the perfect small town ideas you can think of. They make money by recommending products or services to their readers and earning a. These metro areas with fewer than people have the best business climates in America. Agriculture is the primary source of income in the villages. One of the finest possibilities for your organization would be to open a fertilizer wholesale store. The low investment makes a flour mill, one of the best small-town business ideas in India. You can expand the business by supplying products to nearby villages. CURRENT DOWNTOWN BUSINESS MIX IN SMALL TOWNS Although current downtown tenants provide a good base of locally owned businesses, they are often not. Appleton, Wisconsin is ranked as the best city for small businesses. This city, just south of Green Bay, has a growing population of about 75, people. Hair salon and barbershop services are another essential element of everyday small town life. If you want to grow your customer base, you can expand beyond. This type of business would be great at your local festivals, in your down- town business area, or at the local souvenir shop. 5. Local hospitality in a. Some top small-town business ideas include retail shops, restaurants, professional services, fitness studios, pet care, auto shops, event venues, nurseries. We will share six ideas to help you build the best small town business. We're going to talk about managing risk, offering a great product or service. Home Businesses: 10 Ideas That Work Great For Small Towns and Rural Areas · #1 – Organically Grown · #2 – Cleaning Service · #3 – Specialty Gardening · #4 –. Checkout our small scale business ideas and low investment business ideas too. Below is the list of the over 50 small business ideas that will be discussed in. Here are some best practices and a glowing example to learn from. Want to dive into Coffeepreneurship® in the classroom? Sign up for our 3-Day Coffee Business. You can experiment and gauge demand in a small town before committing to a more expensive permanent business. Pop-ups can be as small as a booth, or as big as a. At Small Town Soul we work with town leaders and small business owners through mentoring and training to develop marketing strategies that get results.

How Do You Get Your Logo Copyrighted

It is wise to put a copyright symbol with most logos to educate others that it is copyrighted (even without the symbol it is still copyrighted. Fidealis' solution allows a logo to be protected as soon as it is registered on our platform. The logo is then electronically signed and timestamped. You can, in the US, file for a trademark for a logo (that is used or intended to be used in inter-state commerce) at the USPTO. You can get. Brand Name Registering. It is not compulsory to register for copyright or trademark of your company name and logo. In the United States, you own copyright. Fidealis' solution allows a logo to be protected as soon as it is registered on our platform. The logo is then electronically signed and timestamped. There are a few factors to be aware of before you decide whether you really need to copyright your logo or trademark. 1. Make your logo sufficiently creative. You can't use copyright to protect names, colors or existing works of others. Yes, you can copyright a logo as a work of graphic art. A logo can be protected under copyright law as a form of original creative expression if. You certainly don't have to register the copyright and trademark your company's name or logo. In the United States, you own the copyright as soon as you put. It is wise to put a copyright symbol with most logos to educate others that it is copyrighted (even without the symbol it is still copyrighted. Fidealis' solution allows a logo to be protected as soon as it is registered on our platform. The logo is then electronically signed and timestamped. You can, in the US, file for a trademark for a logo (that is used or intended to be used in inter-state commerce) at the USPTO. You can get. Brand Name Registering. It is not compulsory to register for copyright or trademark of your company name and logo. In the United States, you own copyright. Fidealis' solution allows a logo to be protected as soon as it is registered on our platform. The logo is then electronically signed and timestamped. There are a few factors to be aware of before you decide whether you really need to copyright your logo or trademark. 1. Make your logo sufficiently creative. You can't use copyright to protect names, colors or existing works of others. Yes, you can copyright a logo as a work of graphic art. A logo can be protected under copyright law as a form of original creative expression if. You certainly don't have to register the copyright and trademark your company's name or logo. In the United States, you own the copyright as soon as you put.

To trademark your logo, you will need to file an application form with the United States Patent and Trademark Office (USPTO). Copyright protection is automatically granted to original works, including logos, as soon as they are created and fixed in a tangible form. One more caveat to copyrighting is that if you hire a designer to create your logo, the original copyright is theirs. When it comes to a work of creative. The filing fee for a copyright registration varies. It's a lot cheaper than filing a trademark application, at the very least. Yes, a logo is automatically protected by copyright law upon its creation, without the need for formal registration in the United States or. A term of copyright in India is 60 years. Both published and unpublished work can be registered under in copyright. Use the interactive web forms or download a trademark application. If you prefer not to use the interactive forms online, the easiest way to get an application. Logo copyright is the legal right to use, distribute, and promote your logo design anywhere. This means you have exclusive ownership and control over how your. There is no law that prohibits a business from claiming both copyright and trademark protections for their logo. A business can use trademark protection to. Yes. A logo that includes artistic or design elements, (i.e. not just the name on its own), is legally regarded as being a work of artistic creation. A copyright on your logo means that you are legally protected regarding the use, rights, and distribution of your logo. Register your work or learn more about the registration process with the Copyright Office. Learn More. Person signing document. Recordation. Record transfers of. To get started registering your work, log in to the Electronic Copyright Office (eCO) Registration System at the link below. In most instances, you can copyright a logo because it is generally artistic and creative. As a result, the United States Copyright Office does offer. Copyright protection is automatically granted to original works, including logos, as soon as they are created and fixed in a tangible form. It is easy to copyright or trademark a logo but the prescribed procedures need to be followed. Though it's a long process, but once it is done, it is worthy of. Our general recommendation to a business looking to protect a logo would be to get a copyright registration in the first instance. Yes, you can copyright and trademark a logo; however, it is important to understand the difference between these two types of intellectual property protection. Your business logo may need a trademark, or a copyright, or often both. You can apply for a logo trademark at the US Patent and Trademark Office and a. Offline registration requires your physical presence in the copyright office while the online process is much easier and faster than it. To make copyright.

Upstart Pros And Cons

Upstart loans Pros & Cons · APRs as high as %. · Charges an origination fee of up to 12% of the loan amount. · No co-sign option. Many business loans, on the other hand, do help your business credit history. You may decide those cons don't matter too much. And if that's the case, you'll. Co-signers for a personal loan aren't accepted. Upstart charges both late fees and origination fees, with origination fees ranging from 0% to 12%. According to reviews on Glassdoor, employees commonly mention the pros of working at Upstart to be culture, career development, benefits and the cons to be. Founded by ex-Googlers, Upstart looks beyond the FICO score to assess borrowers based on work and education history. Whether you are looking to pay off credit. Working at Upstart: 21 Reviews · Overall rating · Fun and supportive place to grow in! · Featured review · Pros · Cons · Not an ideal place to work · Pros · Cons. Yes, Upstart is legit because it has an A+ rating from the Better Business Bureau and it has been BBB-accredited since Upstart personal loans received a. Working at Upstart: 21 Reviews · Overall rating · Fun and supportive place to grow in! · Featured review · Pros · Cons · Not an ideal place to work · Pros · Cons. Upstart has an A+ rating with the Better Business Bureau, which means it's excellent at handling customer services and issues. Positive reviews on several. Upstart loans Pros & Cons · APRs as high as %. · Charges an origination fee of up to 12% of the loan amount. · No co-sign option. Many business loans, on the other hand, do help your business credit history. You may decide those cons don't matter too much. And if that's the case, you'll. Co-signers for a personal loan aren't accepted. Upstart charges both late fees and origination fees, with origination fees ranging from 0% to 12%. According to reviews on Glassdoor, employees commonly mention the pros of working at Upstart to be culture, career development, benefits and the cons to be. Founded by ex-Googlers, Upstart looks beyond the FICO score to assess borrowers based on work and education history. Whether you are looking to pay off credit. Working at Upstart: 21 Reviews · Overall rating · Fun and supportive place to grow in! · Featured review · Pros · Cons · Not an ideal place to work · Pros · Cons. Yes, Upstart is legit because it has an A+ rating from the Better Business Bureau and it has been BBB-accredited since Upstart personal loans received a. Working at Upstart: 21 Reviews · Overall rating · Fun and supportive place to grow in! · Featured review · Pros · Cons · Not an ideal place to work · Pros · Cons. Upstart has an A+ rating with the Better Business Bureau, which means it's excellent at handling customer services and issues. Positive reviews on several.

Upstart Personal Loans Pros and Cons. Upstart offers quick funding and will look beyond credit scores while evaluating applicants, but a high maximum APR and. Prosper vs Upstart: Weighing the pros and cons between these two lenders boils down to the borrower's needs and how creditworthy they're deemed to be. Upstart. Pros and cons of using loans to pay cards #creditrepair #creditfix So I have no negative reviews towards upstart? I have not. They have. One potential downside of Upstart is that its loan terms are Pros & Cons. Available to borrowers with bad or no credit. Two-month. While Upstart's quick funding timeline and low credit score requirement make it more accessible, it also charges more fees and has more limited loan terms than. Pros. Caters to low and fair-credit borrowers. Easy to manage your loan with its mobile app. Fast funding. Cons. Not available in all 50 states. Steep loan. orina-garden.ru Upstart Pros and Cons. Pros Bad credit OK: You can have a credit score as low as and still qualify for a loan. More options: This lending. Pros & cons. Pros, Cons. Fast funding: as soon as one business day. Possible origination fee. Accepts borrowers with limited credit history. High maximum APR. Upstart; Best for flexible repayment terms: Upgrade; Best for fast Here are the pros and cons you need to know · The best personal loans if you. Notably, Upstart loans can be used to fund tuition and other education expenses. Many competitors specifically exclude this application. Disadvantages of. Cons of Upstart. Upstart personal loans can carry APRs as high as %. Term lengths can be three years or five years, which might not be right for. Upstart has a competitive minimum interest rate, which is great news for borrowers who qualify for it. However, it also has a maximum interest rate on the. Upstart is rated 57 out of companies in total rating and got an average review score of based on 7 reviews. Their weakness is Interest & Costs and their. Many business loans, on the other hand, do help your business credit history. You may decide those cons don't matter too much. And if that's the case, you'll. Pros and Cons of the Upstart Affiliate Program. Here are some key benefits and drawbacks of the Upstart affiliate program: Pros, Cons. Well-known brand, High. Pros and cons of Upstart personal loans ; Ultra-low credit score requirement, Origination fees range up to 12% ; Lowest APR available of 21 lenders, High. Upstart: Best fast personal loans (for all credit types). SoFi: Best Pros and cons. Pros. Fair credit borrowers eligible. Autopay and direct pay. Upstart is a lending platform that is accessible to borrowers with poor credit. Unlike some other lenders, Upstart doesn't charge a prepayment penalty. Upstart. Upstart, however, made it possible to refinance debt at 25% interest down to under 13%. I can regain my financial footing much faster thanks to Upstart. Pros. Pros: Higher approval odds for low credit borrowers; No prepayment penalties; Can pay creditors directly. Cons: High origination fees; Higher starting APR; No.

Pop Up Art

Pop-up art galleries are less of a financial investment, allow immense flexibility and can be set up and open in a much shorter space of time. As a preview of Art Alive each year, The San Diego Museum of Art brings large floral installations to sites around San Diego as Art Alive Petal Pop-Ups. Jun 1, - Explore Valerie Gudorf's board "Pop Up Art" on Pinterest. See more ideas about pop up art, pop up, pop up cards. The festival will feature “pop-up” public performances and activities at a variety of locations throughout Thousand Oaks. Performing & Visual Arts · Fashion · Health · Sports & Fitness · Travel & Outdoor Seafood Pop Up Seafood Pop Up. Mon, Dec 30 • AM. Connecticut. The festival will feature “pop-up” public performances and activities at a variety of locations throughout Thousand Oaks. A pop-up exhibition is a temporary art event, less formal than a gallery or museum but more formal than private artistic showing of work. POP UP ARTS · Art bureau and artist agency based in Copenhagen. · Explore our newest pieces · Each piece is chosen to reflect a cohesive, contemporary aesthetic. Pop Up Art is designed to spark new interest in all mediums of the visual and performing arts while creating a dialogue around the value of the arts in. Pop-up art galleries are less of a financial investment, allow immense flexibility and can be set up and open in a much shorter space of time. As a preview of Art Alive each year, The San Diego Museum of Art brings large floral installations to sites around San Diego as Art Alive Petal Pop-Ups. Jun 1, - Explore Valerie Gudorf's board "Pop Up Art" on Pinterest. See more ideas about pop up art, pop up, pop up cards. The festival will feature “pop-up” public performances and activities at a variety of locations throughout Thousand Oaks. Performing & Visual Arts · Fashion · Health · Sports & Fitness · Travel & Outdoor Seafood Pop Up Seafood Pop Up. Mon, Dec 30 • AM. Connecticut. The festival will feature “pop-up” public performances and activities at a variety of locations throughout Thousand Oaks. A pop-up exhibition is a temporary art event, less formal than a gallery or museum but more formal than private artistic showing of work. POP UP ARTS · Art bureau and artist agency based in Copenhagen. · Explore our newest pieces · Each piece is chosen to reflect a cohesive, contemporary aesthetic. Pop Up Art is designed to spark new interest in all mediums of the visual and performing arts while creating a dialogue around the value of the arts in.

"Pop-up" Art shows have been gaining popularity and momentum. All you need is a temporary space and someone present to gallery sit your exhibition. up. POP UP FESTIVAL We are thrilled to invite you to our annual POP UP FESTIVAL. Join us and experience art from some of the most talented artists from the. Pop-ups were my foray into paper arts. In , when I spent my junior year abroad in Germany, I took a class in letter arts and discovered a three-dimensional. Veterans Art Project (VETART) hosts the second-annual Statewide Veteran's Pop-up Arts Café on October 17, from 10 a.m - 4 p.m. on the West Steps of the. The officially licensed Pop Up Pop Art Silver Factory collection features iconic Andy Warhol work in pop up books and 3-D greeting cards. City of Thousand Oaks Pop-Up Arts & Music Festival Every Friday/Saturday, May 31 to June 29 The City of Thousand Oaks brings its annual Pop-Up Arts & Music. The Market at NCMA - Pop-Up for Pups. Saturday, October 5, ; AM PM ; North Carolina Museum of Art (map) · Google Calendar ICS. People socializing on a sunny day outside the Crescent Beach Gallery, with flowers in the. Breadcrumb. Home · Arts & Culture · Community Art. Veterans Art Project (VETART) hosts the second-annual Statewide Veteran's Pop-up Arts Café on October 17, from 10 a.m - 4 p.m. on the West Steps of the. City of Thousand Oaks Pop-Up Arts & Music Festival Every Friday/Saturday, May 31 to June 29 The City of Thousand Oaks brings its annual Pop-Up Arts & Music. Apr 27, - Explore Zaueqh's board "Pop-Ups", followed by people on Pinterest. See more ideas about pop up cards, pop up art, pop up book. Check out our pop up art selection for the very best in unique or custom, handmade pieces from our shops. Eventbrite - SOCIAL SPACE presents SOCIAL SPACE | Ottawa Pop-Up Art Event at Glebe Ave. | June 7 -8 - Friday, 7 June at Glebe Ave, Ottawa, ON. Art Pop-Up is an innovative, non-profit arts organisation. We are cultural engineers & community builders. Winners of the Mercury's Best Social Enterprise A Cultural Center without Walls! The Community Arts Pop-Up Cultural Center spreads art to every. From New York's eggcellent pop-up to Melbourne's flower frenzy, here are our top ten picks for this spring's best interactive displays. Pop up shop editable flyer, social media flyer, e-flyer, instagram flyer, gold glitter and black pop-up shop flyer, hair flyer, popup flyer. Art Pop-Up is an innovative, non-profit arts organisation. We are cultural engineers & community builders. Winners of the Mercury's Best Social Enterprise A series of Pop Up Art Shows at the Steveston Museum. On now until Nov 10th enjoy the unique Encaustic Painting style (beeswax-based paint) and clay sculpture. Pop-up Cards · Keychains · Magnetic Bookmaks. Toys & Games. expand. collapse. Toys & Games. Art Toys · Figurines · Plush · Miniature · Board Games · Memory.

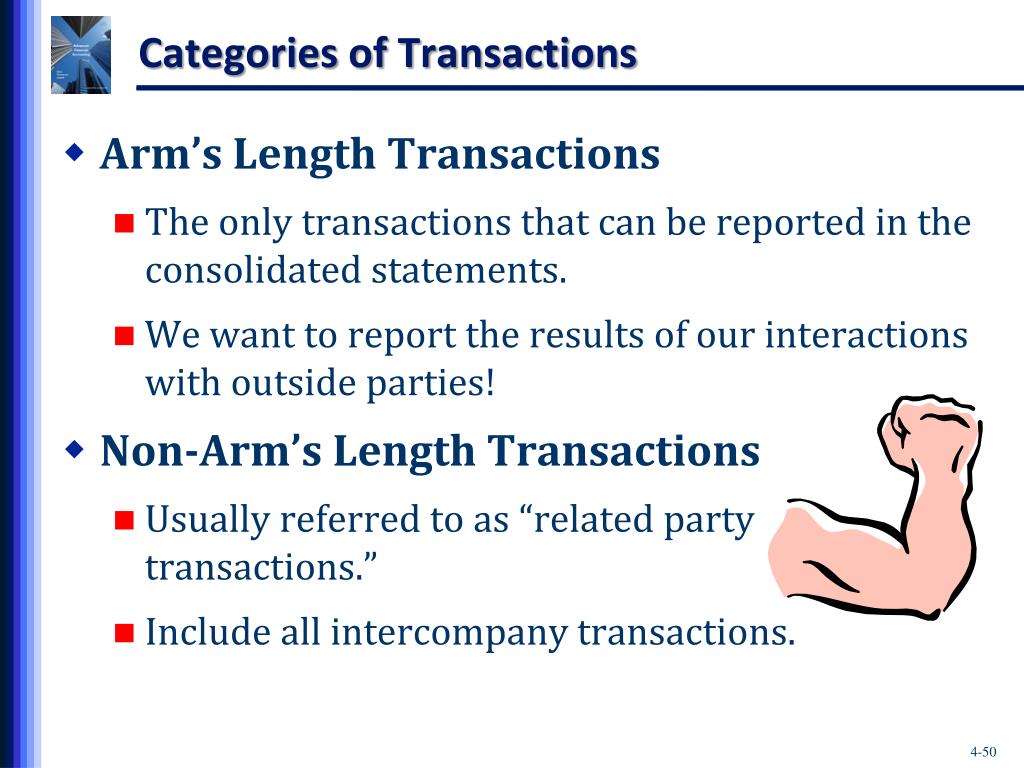

Arms Length Real Estate Transaction

An Arm's Length Sale is a sale of real property in the open market, between an informed and willing buyer and seller where neither is under any compulsion. This term is commonly used in the context of real estate, where an arms-length transaction form is a document that helps to confirm that a real estate. An arms length sale in real estate is when two parties enter into a transaction without any involvement or influence of a third party, and each party is acting. Arm's length” is an expression which is commonly used to refer to transactions in which two or more unrelated and unaffiliated parties agree to do business. In the realm of intellectual property, licensing agreements between unrelated parties are considered arm's length transactions if they reflect. An arm's length transaction is a real estate deal in which the buyer and seller act independently, without any relationship to each other, ensuring that. An arm's-length transaction is a transaction between a buyer and seller with roughly equal bargaining power who are trying to negotiate the best terms for. An arms-length transaction is a sale between a willing buyer and seller that isn't affected by any extraneous circumstances that might have caused the purchase. A non-arm's length transaction in real estate refers to a deal in which the buyer and seller have a pre-existing relationship, whether familial, personal. An Arm's Length Sale is a sale of real property in the open market, between an informed and willing buyer and seller where neither is under any compulsion. This term is commonly used in the context of real estate, where an arms-length transaction form is a document that helps to confirm that a real estate. An arms length sale in real estate is when two parties enter into a transaction without any involvement or influence of a third party, and each party is acting. Arm's length” is an expression which is commonly used to refer to transactions in which two or more unrelated and unaffiliated parties agree to do business. In the realm of intellectual property, licensing agreements between unrelated parties are considered arm's length transactions if they reflect. An arm's length transaction is a real estate deal in which the buyer and seller act independently, without any relationship to each other, ensuring that. An arm's-length transaction is a transaction between a buyer and seller with roughly equal bargaining power who are trying to negotiate the best terms for. An arms-length transaction is a sale between a willing buyer and seller that isn't affected by any extraneous circumstances that might have caused the purchase. A non-arm's length transaction in real estate refers to a deal in which the buyer and seller have a pre-existing relationship, whether familial, personal.

What is the Difference Between an Arm's Length Transaction and Other Sales? An arm's length transaction is a business transaction that occurs between two. In real estate, an arm's length transaction is a deal where the parties act independently without any special relationship, ensuring the transaction. In an arm's length transaction, neither party has an incentive to act against his/her own interest. That is, the seller seeks to make the price as high as he/. An arm's length transaction in the realm of real estate pertains to a scenario where the participants, typically the buyer and the seller. An arm's length transaction in real estate takes place between an unrelated seller and buyer who each act willingly, independently, and in their own best. Affiant further says that there are no agreements or understandings, oral, written or implied, that will permit Seller to remain in the above mentioned property. An arm's length transaction in real estate takes place between an unrelated seller and buyer who each act willingly, independently, and in their own best. Both buyer and Seller are acting in his or her own self-interest, and that the sale price is based on fair market value of the Property. 2. No Buyer or agent of. An arm's length transaction, also known as an unrelated and independent transaction, is a crucial concept in various areas such as taxation, real estate, and. An arm's length transaction, also known as the arm's length principle (ALP), indicates a transaction between two independent parties in which both parties are. In real estate, an arms-length transaction happens when a property is bought and sold between two unrelated parties acting independently, in their own best. (i) Market value means a value which is the fair market value determined as a result of a sale or transfer in an arms-length transaction. property upon sale. Under Canadian tax law, special rules often apply to transfers of money and property between family and friends. The classification of whether a transaction. Arms Length Sales In this application, Arm's Length is also defined as a sale with no conditions, as recorded in Question 15 on the RP form, that would. An arm's length transaction in real estate occurs when a property is transferred but the buyer and seller do not interact with one another; instead, both. (2) "Arm's-length transaction" means a transaction resulting from good-faith bargaining between a buyer and seller who are not related organizations and have. Arm's-length transactions occur all the time in contract situations, business, real estate, securities, and many other types of transactions. A non-arm's length transaction occurs when a buyer and a seller have an existing relationship. This impacts taxation and valuation. An arms length transaction in real estate refers to a transaction where the buyer and seller are unrelated and have no pre-existing relationship or connection.

Chase Bank Address On Checks

Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. Order Chase checks online quickly and easily with Check Print. Save up to 40% by ordering with us instead of your bank. Same checks, better service. Routing and account number information is easily available for Chase customers. You can consult our app, go online, or locate the numbers on your checks. deposit to our National Bank By Mail Team: CHASE By Mail, PO Box Westerville, OH Overnight address is Chase by Mail, S. Bank securely with the Chase Mobile® app: send and receive money with Zelle®, deposit checks, monitor credit score, budget and track income & spend. For customer service, careers, media and more, please see the contact information below. For general inquiries regarding JPMorgan Chase & Co. Use Chase Direct Deposit to save time by depositing your paycheck directly to your account. Download a direct deposit form now! Starting March of - our mailing address for checks has changed to the address below. JPMorgan Chase Bank, N.A. Park Ave New York, NY ABA. Madison Square Garden - New branch. Address: 2 Penn Plz New York, NY Phone: Phone: () () Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. Order Chase checks online quickly and easily with Check Print. Save up to 40% by ordering with us instead of your bank. Same checks, better service. Routing and account number information is easily available for Chase customers. You can consult our app, go online, or locate the numbers on your checks. deposit to our National Bank By Mail Team: CHASE By Mail, PO Box Westerville, OH Overnight address is Chase by Mail, S. Bank securely with the Chase Mobile® app: send and receive money with Zelle®, deposit checks, monitor credit score, budget and track income & spend. For customer service, careers, media and more, please see the contact information below. For general inquiries regarding JPMorgan Chase & Co. Use Chase Direct Deposit to save time by depositing your paycheck directly to your account. Download a direct deposit form now! Starting March of - our mailing address for checks has changed to the address below. JPMorgan Chase Bank, N.A. Park Ave New York, NY ABA. Madison Square Garden - New branch. Address: 2 Penn Plz New York, NY Phone: Phone: () ()

Chase Bank provides a broad range of financial services to almost half of America's households. Over branches and ATMs nationwide. View our Deposit Accounts FAQ for more information, including how to access your accounts on JPMorgan Chase online and mobile banking. In case you missed it. Customer: I am attempting to help my father-in-law to order more checks. However there seems to be some problem with the bank routing number on the deposit slip. banking transactions, teller cash withdrawals, cashed checks and deposited checks drawn on us when presented in the branch, and wire transfers. 6 For. Starting March of - our mailing address for checks has changed to the address below. JPMorgan Chase Bank, N.A. Park Ave New York, NY ABA. Bank By Mail Team: CHASE By Mail, PO Box Westerville, OH Overnight address is Chase by Mail, S. Cleveland Ave Building Your bank's routing number is the nine-digit number located at the bottom left of your checks. Find a routing number without a check. If you don't readily have. Find Chase branch and ATM locations - Park Avenue. Get location hours, directions, and available banking services. Manage your bank accounts · Live customer service when you need it · Quick and easy instant-issue cards · Pay your bills on the go · Deposit checks anytime. Don't fold checks; Don't send cash. Please mail your payment to the address below. Cardmember Services P.O. Box Carol Stream, IL For overnight. The essential elements of a paper check · Top left: The account holder's name and address · Top right: The check number and an empty date field · Bottom left: An. The traditional way to deposit a check is to visit your local bank branch. After endorsing your check, you can fill out a deposit slip, include the check and. Chase customer service and Chase technical support for Chase online banking. Certain information is preprinted on personal checks: the account holder's name, address, plus the account and routing numbers. To write a personal check. Private Bank; Wealth Management. Back to menu. Commercial Banking. Commercial Chase customer service. Chase ATM/Branch locator · Chase Personal Banking. JPMorgan Chase. Deposit Accounts Transition to J.P. Morgan Commercial Bank — FAQ. Account holders and Corporate Online authorized users with checking, savings. View images of checks you've written for up to three years online when you Chase Bank refer a friend for checking accounts. Existing eligible Chase. Answers is a free service. Chase Bank Address For Checks you will have to go to the clerk of court. info is correct or make. Chase Bank Address For Checks. This is mostly because checks can display significant personal information — names, an address and a signature — along with bank account and routing numbers. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Member FDIC. Investing involves market risk, including possible loss of.

Best Lender For Va Home Loan

VA Home Loans are provided by private lenders, such as banks and mortgage companies. VA guarantees a portion of the loan, enabling the lender to provide you. A VA loan is a government-backed mortgage option available to Veterans, service members and surviving spouses. Forbes Advisor compiled a list of VA loan lenders that excel in various areas, including offering low fees, convenience and flexibility. In this article, we'll enumerate these benefits and make a list of the top VA lenders you should be looking up if you have a credit score. Veterans Lending Group is your trusted VA specialty mortgage lender. If you are a Service Member, Veteran, or Military Spouse, you may qualify for the VA Home. A VA mortgage loan is offered exclusively to military service members, active or retired. Our VA home loan requires no down payment or private mortgage. Best VA mortgage lenders · Bank of America: Best overall. · Better: Best for end-to-end service. · Veterans United: Best for loan options. · Navy Federal Credit. VA Home Loans. Lender Statistics. Lenders are persons or entities (private sector or government) that originate, hold, service, fund, buys. Best VA Mortgage Lenders of · What Are the Best VA Loan Lenders? · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City. VA Home Loans are provided by private lenders, such as banks and mortgage companies. VA guarantees a portion of the loan, enabling the lender to provide you. A VA loan is a government-backed mortgage option available to Veterans, service members and surviving spouses. Forbes Advisor compiled a list of VA loan lenders that excel in various areas, including offering low fees, convenience and flexibility. In this article, we'll enumerate these benefits and make a list of the top VA lenders you should be looking up if you have a credit score. Veterans Lending Group is your trusted VA specialty mortgage lender. If you are a Service Member, Veteran, or Military Spouse, you may qualify for the VA Home. A VA mortgage loan is offered exclusively to military service members, active or retired. Our VA home loan requires no down payment or private mortgage. Best VA mortgage lenders · Bank of America: Best overall. · Better: Best for end-to-end service. · Veterans United: Best for loan options. · Navy Federal Credit. VA Home Loans. Lender Statistics. Lenders are persons or entities (private sector or government) that originate, hold, service, fund, buys. Best VA Mortgage Lenders of · What Are the Best VA Loan Lenders? · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City.

Landing page with resources and links to information for VA home loan guaranty lenders.

Hero Loan can close VA Loans in as little as 14 days–compared to most lenders that take up to 60 days. And you can get started with their 5-Minute Loan. Veterans United Home Loans is the nation's #1 VA Lender and has received over , five-star reviews from Veterans and military families. Veterans United. Dash Home Loans offers VA loans in NC and SC to help you and your family purchase a home with no money down. See if you qualify, and apply for a VA loan. VA loans help millions of eligible military Veterans and active-duty personnel purchase or refinance their homes and provide % financing. · Lower interest. VA Home Loans are provided by private lenders, such as banks and mortgage companies. VA guarantees a portion of the loan, enabling the lender to provide you. Is a VA Guaranteed Loan Always the Best Option? No. Veterans must weigh all the options to consider what is best for them and their family. This program gives. USAA Bank is ranked one of the top VA mortgage lenders. 20+ Years USAA Bank has more than 20 years of experience with VA home loans. Best VA Loan Lenders ; Veterans United Home Loans. ; Veterans First Mortgage. ; PenFed Credit Union. ; Freedom Mortgage. A VA mortgage loan is offered exclusively to military service members, active or retired. Our VA home loan requires no down payment or private mortgage. Veterans United Home Loans is the nation's #1 VA Lender and has received over , five-star reviews from Veterans and military families. Veterans United. Best VA Mortgage Lenders of · What Are the Best VA Loan Lenders? · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City. Rocket Mortgage is one of the largest mortgage lenders in the game. It offers all of the essential VA programs: purchase, cash-out refinance and streamline. We have compiled a list of 10 Best VA Home Loan Lenders In United States that you can choose for financing your dream house. A VA loan makes it easier for veterans, active duty military members and eligible surviving spouses to purchase or refinance their home. VA Home Loan Overview · For Veterans, service members, and their survivors · Offers up to % financing- no down payment required (must have sufficient VA. We help Veterans become Homeowners. See why more Veterans and military families chose Veterans United for their VA home purchase than any other lender in. VA Home Loan Overview · For Veterans, service members, and their survivors · Offers up to % financing- no down payment required (must have sufficient VA. Lone Star Financing is an approved mortgage lender for Texas VA loans, USDA loans and FHA home loans in Texas. Voted one of the best VA lenders in Texas. Veterans United won best overall for VA loan rates because it specializes in VA loans, veterans are their primary clients, and they have many loan program. Hero Loan can close VA Loans in as little as 14 days–compared to most lenders that take up to 60 days. And you can get started with their 5-Minute Loan.